History may well mark the typically somnambulant first days of August as the week that forever changed the U.S. newspaper industry.

In a stunning sequence of events, two young billionaires with no media experience bought iconic East Coast newspapers and affirmed their commitment to helping to rejuvenate an industry that has been in freefall for the past seven years.

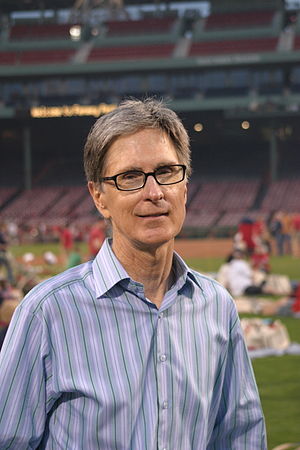

The Washington Post Co. announced yesterday that Amazon.com founder Jeff Bezos would buy the company’s namesake newspaper for $250 million, ending eight decades of stewardship by the Graham family. The news came just three days after billionaire commodities investor John Henry was announced as the new owner of the Boston Globe.

The news continues a trend toward deep-pocketed investors making substantial investments in news organizations, shoring up depleted reporting staffs and experimenting with new business models. Value-investing icon Warren Buffett has snapped up more than 60 dailies and says he plans to buy more. In Southern California, greeting card magnate Aaron Kushner and his partners at Freedom Communications are turning heads with an aggressive investment strategy at the Orange County Register that is showing early signs of bearing fruit.

This is the best news the newspaper industry has had in years, and we think the management styles of these investors symbolizes the kind of long-term view that the business badly needs.

Long-Term Vision

| Why Billionaires Are Trying to Rescue the Newspaper Industry |

Let’s look at the two newest arrivals on the media scene. We’ve watched both Henry and Bezos with interest for years, but for different reasons. Henry is the white knight who rescued our hometown Boston Red Sox from a tumultuous management struggle and brought the town its first World Series victory in 86 years. Bezos is an Internet pioneer who steered his company to greatness in a turbulent industry and forever changed retailing. The two men made their fortunes in very different industries but share a commitment to long-term vision and a belief in fundamental values.

When Henry took over the Red Sox in 2002, the team was actively negotiating to abandon Fenway Park and build a new stadium in the suburbs. The new owner promptly scuttled the negotiations and redoubled his investments in the team’s home field, shoring up the infrastructure, adding seats and experimenting with new revenue sources that would keep the team competitive with other big-market players. The strategy has paid off. The 101-year-old stadium is a huge tourist draw, and high ticket prices combined with innovative promotions have enabled the team to support a payroll and farm system that consistently keeps it at the top of the American League East. Fans complain about ticket prices, but they can’t complain about the team’s performance on the field.

Bezos was one of hundreds of online booksellers that jumped on the early Internet. He successfully steered Amazon through the ravages of the dot-com crash and intense competition from brick-and-mortar retailers to make it a $61 billion powerhouse that has changed the way Americans shop. Bezos has kept his focus on core principles like personalizing the shopping experience and delighting customers. He has resisted the urge to chase short-term opportunities and focused instead on big picture problems like chipping away at the cost and frustration of shipping. See Michael Moritz’s profile for a financier’s account of Bezos’ brilliance.

Amazon made some early missteps, such as investments in busted Web 1.0 startups like Pets.com and Kozmo.com, but it has executed almost flawlessly since the end of the dot-com bubble. It has sacrificed profitability for growth, but that hasn’t stopped the stock from rising ninefold over the last five years. With Amazon still under-performing in international markets and just beginning to crack the business-to-business opportunity, there is reason to believe its best days are ahead of it.

Rule-Changers

Long-term thinking as exemplified by Henry and Bezos is exactly the tonic the newspaper industry needs. Its woes are rooted in a merger binge that started in the late 90s, fueled by an appetite for short-term profits. As online competition has eaten away the circulation and revenue base of the U.S. industry, most publishers have responded by cutting costs, raising prices and hoping for the best. But you don’t transform an industry by cutting costs. You do it by changing the rules. Bezos and Henry are rule-changers.

Editor & Publisher reported last week on newspapers that are successfully experimenting with new revenue sources. We have long maintained that growth opportunities exist for publishers in local markets if they can break their advertising addiction and partner with businesses in new ways. Wouldn’t it be nice to see the Post and the Globe blazing these trails?

It’s tempting to dismiss these relatively small investments (the $250 million purchase price of the Post represents just one percent of Bezos’ net worth) as low-risk bets by people with money to burn, but we think there’s more to it than that. Wealthy entrepreneurs know that healthy, independent media are essential to democracy and to capitalism. Media watchdogs keep government and regulatory excesses in check and ensure that markets operate predictably. They also provide business intelligence that isn’t easily available elsewhere. Both Henry and Bezos are avid newspaper readers.

We have no reason to believe that either of these new media owners has any plans to try to wring cash out of a dying business. On the contrary, Henry was quick to issue a statement affirming his belief in the importance of a healthy Globe to the region. Bezos is leaving the current Post leadership in place and said no layoffs are planned. “The values of the Post do not need changing,” he said. “The duty of the paper is to the readers, not the owners.”

Some people have speculated in recent years that the salvation of the newspaper industry would be donations from foundations and wealthy investors. Perhaps there’s some truth in that, but donations are a backhanded way of saying that a cause can never support itself. Warren Buffett, John Henry and Jeff Bezos all have their own philanthropic interests, but we don’t believe they see these newspaper investments as charity. They see value, growth and ultimately something that has eluded publishers for the last several years: profit.

Related articles

Amazon’s Jeff Bezos to Buy Washington Post for $250 Million

Amazon’s Jeff Bezos to Buy Washington Post for $250 Million Bezos is brilliant, secretive, ‘geeky’ – and soon to be publisher of the Washington Post

Bezos is brilliant, secretive, ‘geeky’ – and soon to be publisher of the Washington Post Why are billionaires like Bezos buying newspapers?

Why are billionaires like Bezos buying newspapers? Biographical info on Amazon founder Jeff Bezos

Biographical info on Amazon founder Jeff Bezos Jeff Bezos and the Washington Post: a marriage of old media and new money | Emily Bell

Jeff Bezos and the Washington Post: a marriage of old media and new money | Emily Bell Challenges face Bezos as he buys Washington Post

Challenges face Bezos as he buys Washington Post